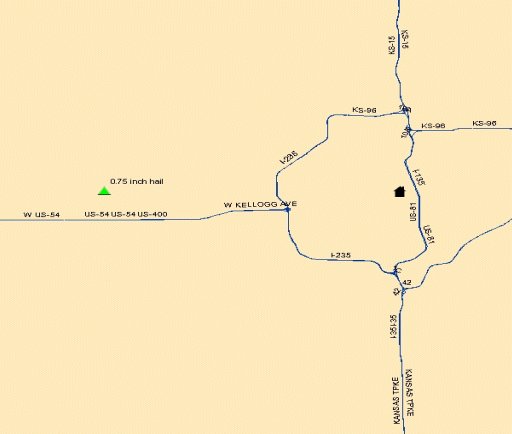

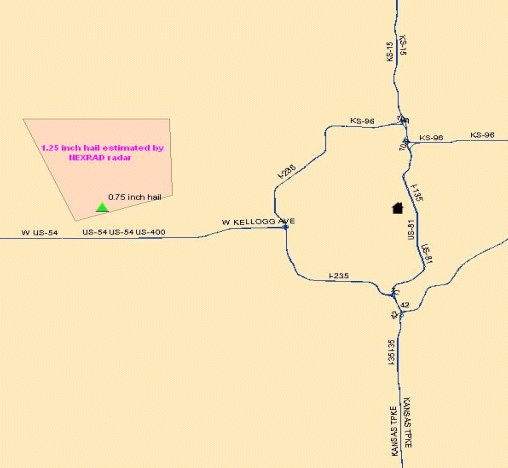

The Scenario: It's a typical mid-summer day in Hutchinson, Kansas. As you leave for work in the morning, the local news reports that there is a slight risk for severe weather in your area. Around 3:30 PM, a severe thunderstorm with one inch hail and 60 MPH wind gusts moves across Hutchinson causing moderate structural damage to homes in the area. You race home from your job in Sterling, Kansas, which is about 18 miles north-northwest of Hutchinson and end up driving through the same system that blew through your community 15 minutes earlier. You will learn later that the squall line stretched from the southeast to the northwest, from just west of Wichita to Sterling. When you survey the damage at home, you notice that your siding appears to have been pitted by wind driven hail. Your first thought is to take pictures and contact your insurance company. Before you get a chance to call the claims center of ABC Insurance, you call your brother-in-law in Wichita, Kansas, 41 miles to the south-southeast to see if he had any hail damage to his home. He says that they had some rain but no severe weather. You hang up the phone and file a claim with ABC Insurance to have your home's siding replaced. Meanwhile, your brother-in-law remembers that he was paid on an insurance claim for his home's siding that was damaged in a hail storm three years ago from the XYZ Insurance Company. He never had the siding repaired and used the money for a weekend trip to Las Vegas. Now that he is with ABC Insurance, he decides to also file a claim saying that his siding was damaged by hail in today's storm. "How will they know that hail didn't damage my home today? The severe weather was near here… I see another trip to Vegas in my future!" Later in the week, a Loss Manager at ABC Insurance's corporate office in San Diego, California has two claim files on his desk. Both are for siding damaged by hail in Kansas. One is in the city of Hutchinson and the other is in Wichita. He reviews the pictures of the damage and reads the local adjuster's notes on the damage assessment. The local adjuster mentions in his report that the damage at the home in Wichita is puzzling. He lives a few blocks away from the claimant and no hail fell at his home, only some rainfall. The Loss Manager must now determine if hail fell on that day in Kansas, and if so, was it near both of his insured? ABC Insurance belongs to an insurance trade association that archives daily severe weather reports from the Storm Prediction Center. He goes to their website, enters the event date and Hutchinson, Kansas into the search box and pulls up a report of one inch hail, driven by 60 MPH wind gusts. Based on the information from the Storm Prediction Center and the report from the local adjuster, your claim is paid and you use the money to replace your siding. The Loss Manager now turns his attention to the hail loss in Wichita. The notes from the local Claims Adjuster concern him. He goes back to the historical catastrophe database and enters the date of loss and Wichita, Kansas into the search box. A report of 0.75 inch hail is listed in Wichita. Since your brother-in-law's insurance policy has been in effect for less than a month, a search is also conducted to see if any hail reports were received in the past five years in the Wichita area. A large hail storm that devastated the area pops up from three years ago. The Loss Manager makes a note of this. The next step is to download the severe weather reports for the claim date and load it into a Geographic Information System which will display the severe weather events and the location of his insured on a map. This will allow him to see how close the hail report was to the insured.  The map displays and the Loss Manager is not surprised to see that the 0.75 inch hail report is ten miles to the west of the insured's property. The Loss Manager decides to also download the NEXRAD data for the day and load it into his GIS program. One of the features of the NEXRAD system is that it estimates the hail size and wind speed of particular storm cells on its Storm Attributes Table. Even though this is an estimate, he wants to determine if the radar detected any hail near the insured on the date of loss.  The Loss Manager quickly determines that not even the NEXRAD data supports the insured's claim that large hail fell and damaged his siding. The claim file is forwarded to the insurance company's Special Investigations Unit and the assigned investigator finds out that your brother in law filed a claim with the XYZ Insurance Company three years ago for the same hail damaged siding. Based on this analysis, your brother in law's insurance claim is denied, his homeowner's policy is cancelled and he is lucky that the ABC Insurance Company will not be prosecuting him for insurance fraud. Forensic Meteorology and the Insurance Industry Traditional broadcast and private meteorologists forecast what will happen in the future. Forensic meteorologists must determine if an event actually occurred and where. With claims validation in the insurance industry, it is normally as simple as the previous example, where severe storm reports and NEXRAD storm attributes are archived in a database and made searchable for the insurance company's adjusters. Where forensic meteorologists really shine is when they are called upon to reconstruct the atmospheric conditions at a given time and place. A great example is with Hurricane Katrina and "wind versus water" exclusions in homeowner's policies. Most homeowner's policies will not cover damage caused by rising water, but will cover damage for wind loss and rain. Forensic meteorologists were called to testify in some court cases to determine if the structural damage was caused by Katrina's storm surge, which would be excluded on a typical homeowner's policy, or by the hurricane force winds damaging roofs and windows of homes, with the interior of the structure and contents of the home being damaged by the accompanying rain which fell through the openings in the dwelling. This would be a covered peril. Utilizing satellite and radar data, forensic meteorologists were able to determine the path and intensity of the storm and when precipitation fell at a specific location. Anemometers at surface observation stations (that were not damaged by the initial landfall of the storm), local storm reports and NEXRAD Storm Attribute Table wind data were used to establish wind speeds at the surface. Satellite and aerial photography, overlaid onto U.S. Geological Survey topographic maps, were loaded into Geographic Information Software to determine the depth of standing water around structures. With all of this information compiled, the forensic meteorologist is able to determine when the destructive wind and rain reached the property, in relation to the storm surge or floodwaters, thereby validating or disproving the insured's claim of damage caused by wind versus water. Insurance companies are relying more on the knowledge of forensic meteorologists, and it is not limited to hurricanes and flooding. Lightning strike verification, high wind events (tornadoes, straight line wind and microbursts) and winter precipitation (roof collapse due to heavy snowfall and electrical disruption due to freezing rain coated power lines) are some of the more popular occurrences where the expertise of a forensic meteorologist is utilized. Reconstructing the weather can be almost as difficult as forecasting it. |